I’ve never been a huge fan of PayPal, but the kind of behavior I recently noticed just takes the cake.

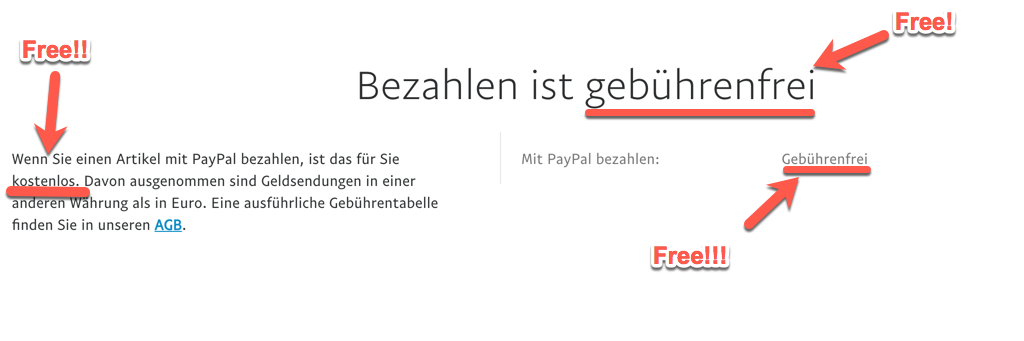

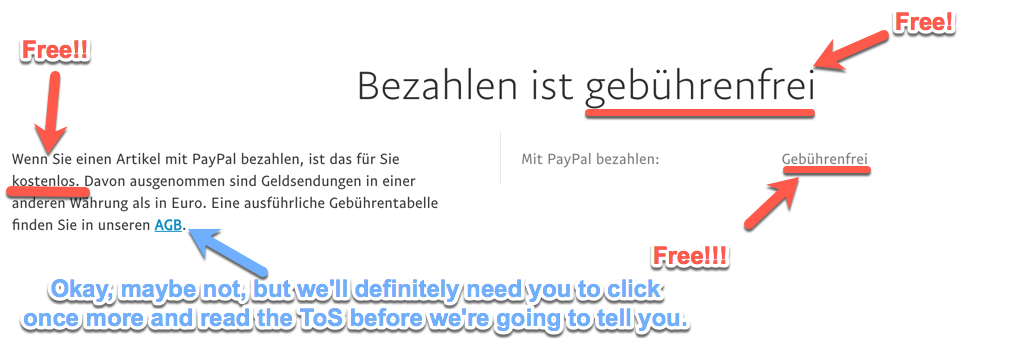

Do you hate it when someone is trying to rip you off? Of course you do. Especially with companies that tell you how “fair and transparent” their pricing is, who tell you that “Buying is free” 3 times on their pricing page like this:

Surely, a company so focused on fairness and transparency wouldn’t screw you - right? Wrong.

Story Time: Buying an article with PayPal

Buying something online is a familiar story and it usually goes something like this:

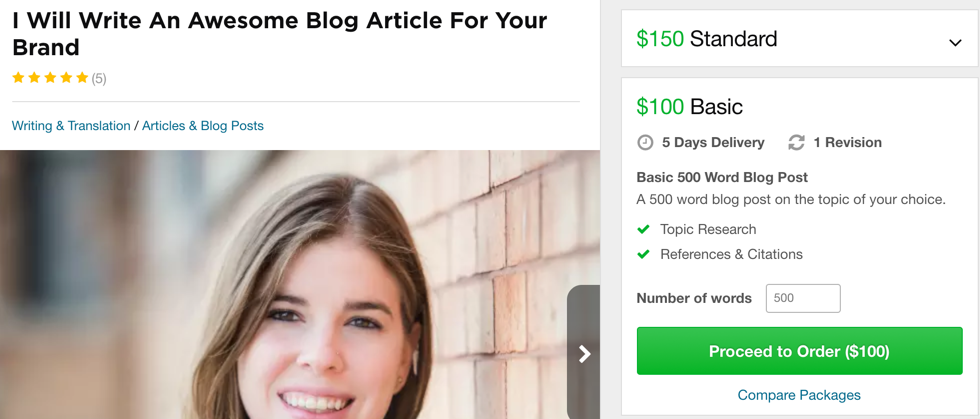

You select the item you want - for example a high-quality blog post from Fiverr:

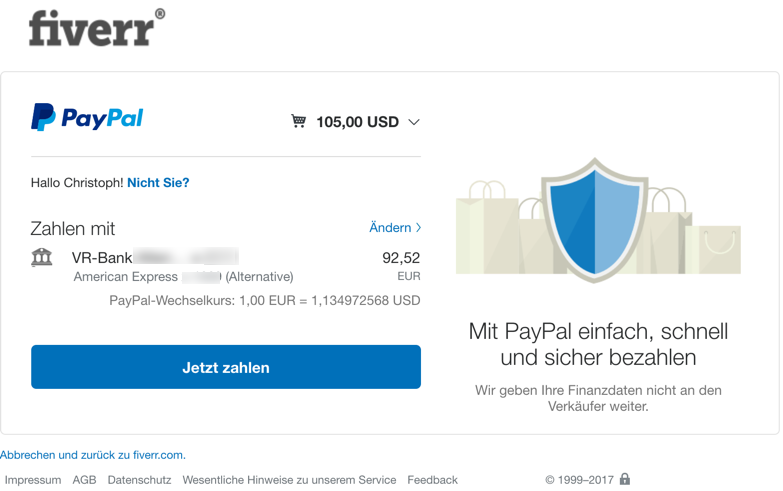

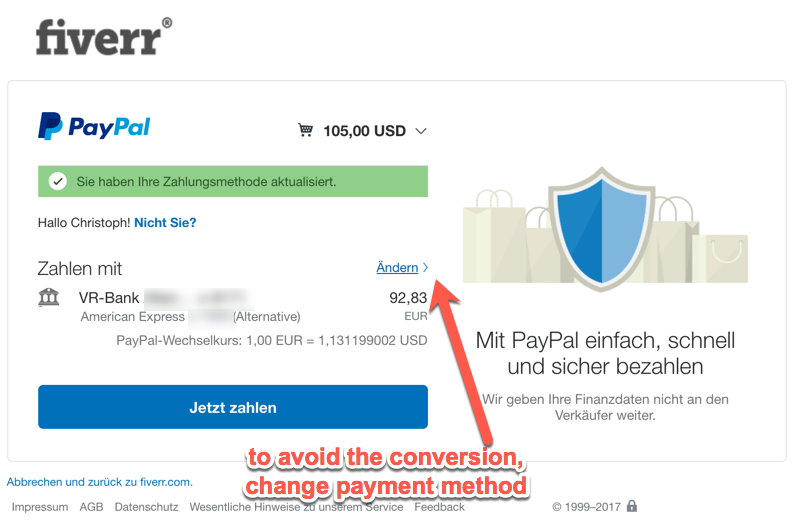

Then you click a few times and eventually land on a Paypal checkout page like this:

And that’s where things get ugly.

PayPal’s hidden fees

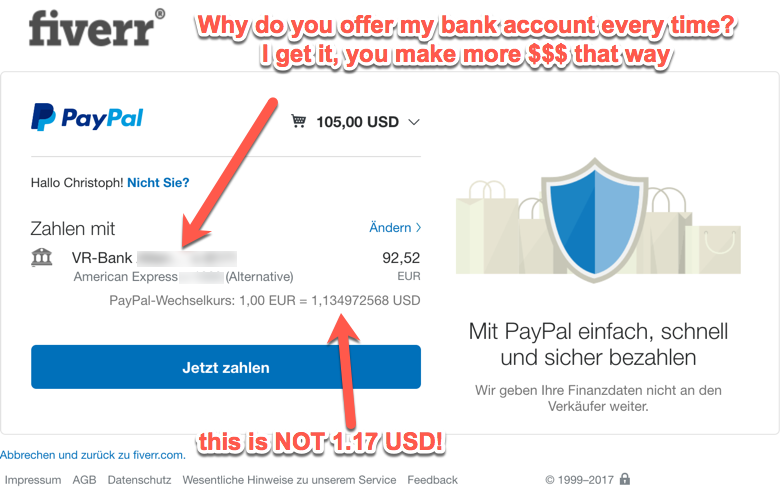

Because you’ll notice that the conversion rate PayPal offers you is too low:

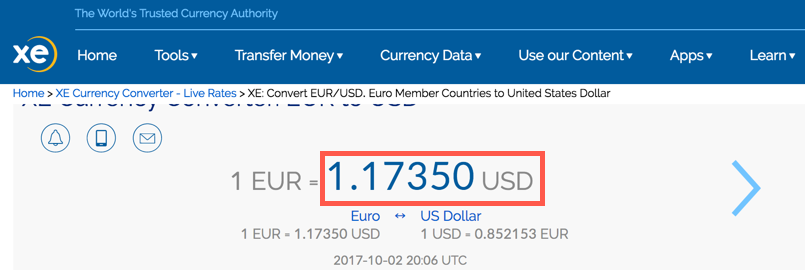

For comparison, here’s the mid-market rate for USD/EUR on this day:

So PayPal is factoring in a 3% foreign exchange fee into this transaction - nice!

PayPal makes both the seller and YOU pay

Look: I understand that PayPal needs to make money.

But come on! They are charging Fiverr.com 4.4% for this transaction - according to their own pricing page.

And then they are charging you an additional 3% on top of that?

$7.77 in fees to move $105 - or rather $97.23? That’s a rip-off. Sorry, but not sorry!

By comparison the same transaction done via Stripe only costs $3.87 - less than half! And with Stripe the seller pays everything.

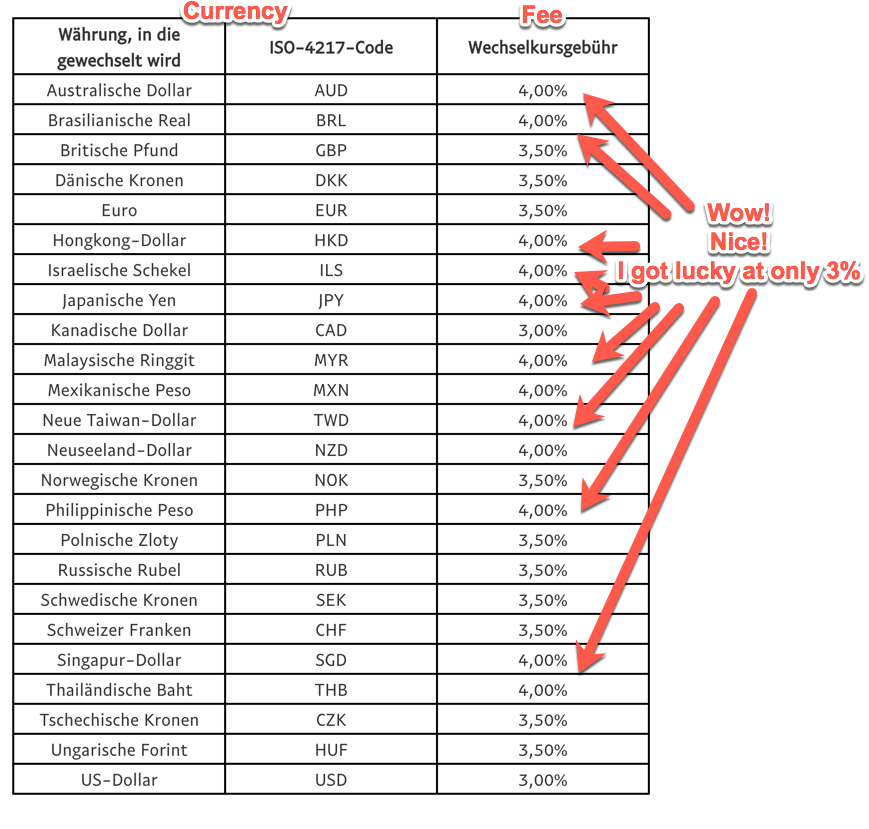

PayPal charges insane FX fees

As you’d expect PayPal charges pretty high FX fees - even my AMEX business card only charges 2% FX fees - saving me $1.05 on this single transaction. PLUS: I get reward points on that transaction worth about $1.50.

My other credit cards charge even less: 1.75. I did some digging around, comparing about 7-8 credit card deals in Germany: Not a single one charges more than 2% FX fee. Good job, PayPal, you’re charging at least a 50% premium!

Heck, some credit cards in the US (e.g. the Chase Sapphire Reserve) do not charge any FX fees at all.

I know what you’re thinking right now: “Come on, it’s only a few dollars”.

Sure, it’s only a few dollars on this transaction. Admittedly I don’t use PayPal enough for this to be a major concern, but other people do.

If you’re spending $1,000 a month in a foreign currency, not unheard of for even small businesses, PayPal is tricking you out of $360. I meant to say: They are providing stellar service in exchange for modest fee of $360 per year (plus the $528 they charge the seller)

Here’s why I think this is a deliberately misguiding practice

We all know that a few dollars here and there add up fast. If you don’t believe me, put $3 in a jar every time you buy a coffee at Starbucks or do similar small purchases - you’ll be amazed.

PayPal knows this, too.

On their (German language) pricing page, this is what you’ll find:

They scream “FREE” every chance they get - and then mention the real fees only in smallprint. You have to click on the link, read through their Terms of Service (we all know that no one does that) to find this table:

That’s not exactly fair and transparent in my book…

The PayPal UI is tricking you into letting them handle currency conversions

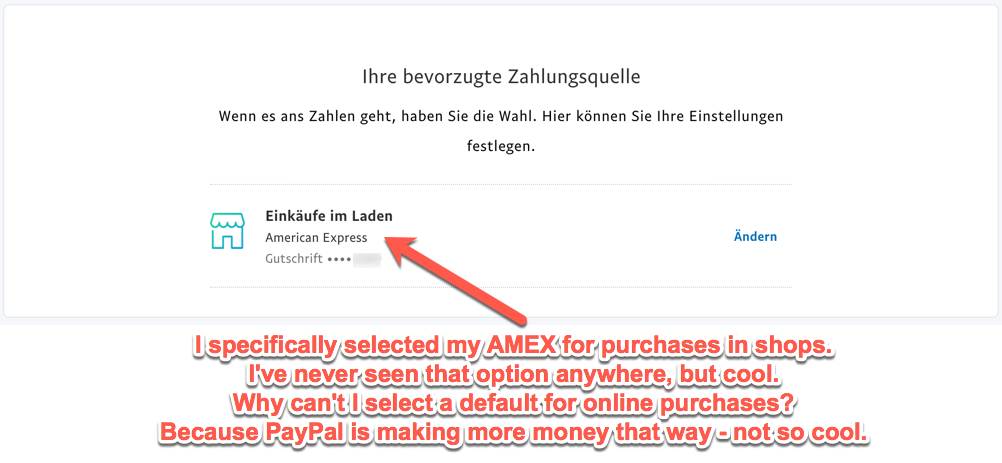

Another reason why I believe this 100% intentional, is that you can not set a preferred payment method for PayPal. They’ll just “assume” that you always want to be charged directly to your bank account.

Well, that’s not entirely true. You can select a preference for buying in shops - of which there are a total of 4(in words: four) available:

But you can’t select a preference for any other form of transaction. And PayPal just does not (want to) remember the payment method you used for your last transaction.

Because if they did, they’d lose out on those juicy FX fees.

How you can avoid these fees

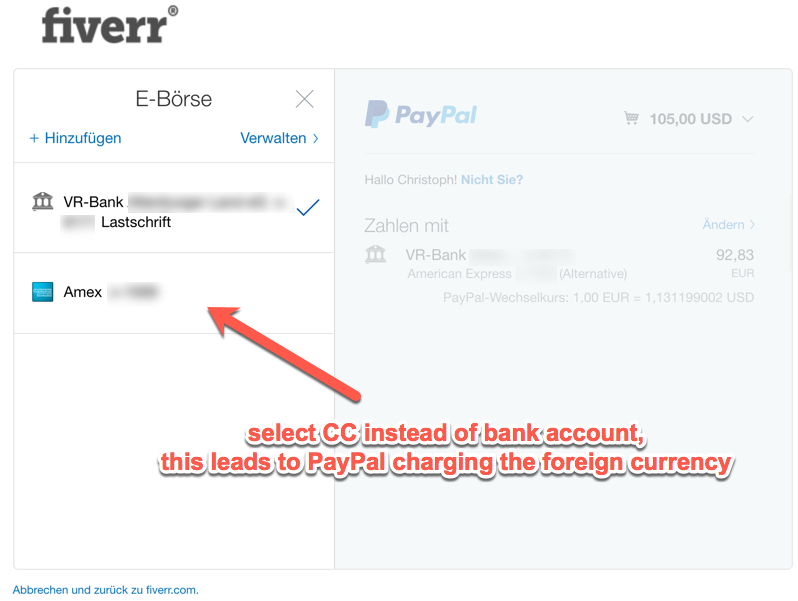

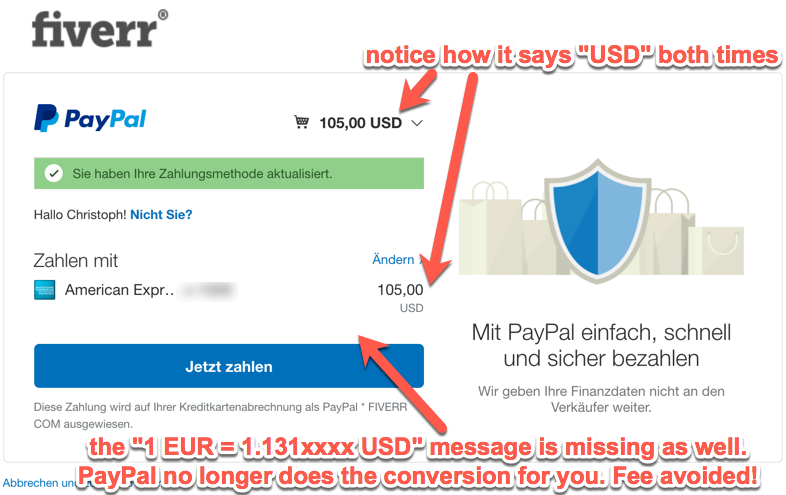

There’s an easy (as in “it only needs three clicks every time”) way to save on PayPal’s abhorrently high fees: Never let them handle currency conversions for you

Update: Since it was a bit unclear how to do this, here are some screenshots that show you how:

Is Paypal ripping you off?

To answer the initial question: well, certainly not legally, their lawyers surely have all bases covered. On the other hand, the way they design their website and checkout flow tells me, that they don’t want you to think about their hidden fees all too much.

So next time you find yourself buying something through PayPal, double-check that they are not doing the conversion for you.

Your business should be enabling your dreams

Crank up your SaaS growth to 11 with the right email marketing & automation workflows. Sign up and learn how to:

- improve customer retention

- make your funnel overflow with leads

- get more word-of-mouth going for your SaaS

- BONUS: Free sample chapter from my book